Start with the Right Gold Calculator Strategy

A calculator gives you a number. Understanding that number gives you leverage. Learn how professional buyers value your gold and how to negotiate the best payout using our advanced gold calculator insights.

Using a gold calculator is the essential first step for any seller. But the number on the screen is rarely the cash offer you'll receive at a counter. The gap between "Melt Value" and "Payout" is where knowledge pays off.

In this expert guide, we go beyond basic math. We explain the difference between spot price and bid price, how to avoid the "Troy Ounce vs. Standard Ounce" trap when using a scrap gold calculator, and why local scrap buyers operate on wider margins than online refineries. Whether you are valuing old jewelry, coins, or dental scrap, this guide is your blueprint for profit.

The Science of Gold Valuation

To understand what your gold is worth, you must first understand the formula used by every refinery and gold calculator in the world. It is not arbitrary; it is a precise mathematical calculation based on three variables.

Industry Standard Formula

= Full Gold Calculator Value

Spot Price Dynamics

The "Spot Price" is the benchmark rate for 1 Troy Ounce of pure (.999) gold. It is determined by global futures markets such as COMEX and LBMA. Our gold calculator fetches this data live to ensure your estimate reflects the current market moment.

The "Bid" vs. "Ask" Spread

Buyers pay the "Bid" price. Sellers (dealers selling to you) charge the "Ask" price. The gap is the spread. Most consumer-facing tools default to the mid-market rate, but be aware that physical dealers will always buy below spot using their internal gold calculator.

Avoid the 'Ounce' Trap: Mastering Weights

A frequent error when using a gold calculator involves weight units. Standard kitchen scales measure in Avoirdupois Ounces, while precious metals use Troy Ounces.

Troy Ounce (ozt) vs. Ounce (oz)

- 1 Troy Ounce (ozt) = 31.1 grams

- 1 Standard Ounce (oz) = 28.35 grams

A Troy Ounce is heavier. If you input standard ounces into a gold calculator expecting Troy Ounces, you will over-estimate your gold's weight by about 10%. We strongly recommend weighing in Grams to avoid this ambiguity perfectly.

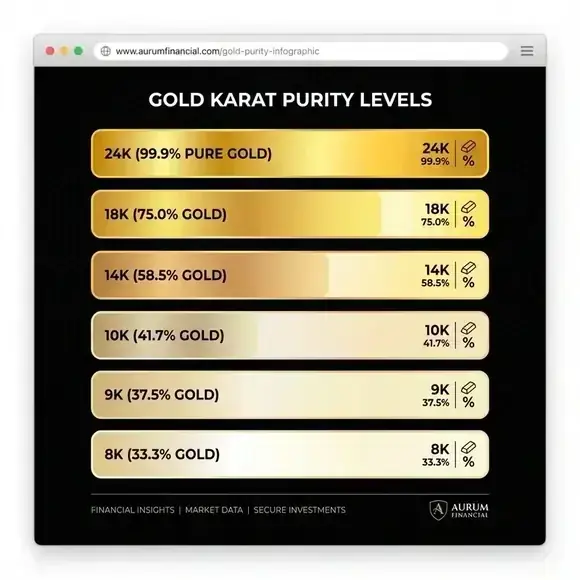

Decoding Purity: Is it 14k or 18k?

The most critical input for any gold calculator is the purity percentage. Gold is too soft to be used in jewelry in its pure 24k form, so it is alloyed with other metals.

Understanding Hallmarks

Inspect your jewelry for a tiny stamp. This 'hallmark' guarantees the gold content and acts as the primary data point for any gold calculator.

Fake Gold Warning

Markings such as GP (Gold Plated), GF (Gold Filled), or HGE (Heavy Gold Electroplate) indicate the item is NOT solid gold. These items contain a negligible layer of gold over base metal and should not be valued as solid gold in any gold calculator.

DIY Verification: Is It Real?

Before calculating a price, verify authenticity. Here are three simple home tests.

Magnet Test

Gold is non-magnetic. If your chain sticks to a magnet, it contains steel or iron and is likely fake or plated.

Float Test

Gold is dense. It should sink immediately in water. If it floats or hovers, it is not real gold, and no gold calculator can help you.

Visual Insp.

Look for discoloration. If the gold color is flaking off to reveal a grey or green metal underneath, it is plated.

Where to Sell: Maximizing Payouts

The value shown on our gold calculator is the 100% melt value. Buyers must make a profit, so they pay a percentage of this.

Online RefineriesHigh Payout

Direct refiners typically offer 90-95% of spot value, often matching closely to gold calculator estimates.

Pawn ShopsLowest Payout

Convenient cash, but high overheads result in offers of 40-60%.

💡Negotiation Strategy

Always walk in knowing your number. Use this gold calculator as your baseline. Set the "Dealer Discount" slider to 20% to see a "fair" offer price. If a local shop offers you 50% of the melt value, you can confidently negotiate or walk away. Aim for at least 70-80% when selling to local jewelers.

Investing in Gold: Coins vs. Bars vs. Jewelry

Not all gold is created equal when it comes to ROI (Return on Investment). A gold calculator will reveal that jewelry often sells for much less than its original purchase price. If you are looking to buy gold to preserve wealth, avoid jewelry.

Sovereign Coins

Gold Eagles, Maples, Pandas

High liquidity. Recognized worldwide. Usually carry a 3-5% premium over spot when buying.

Bullion Bars

PAMP, Valcambi (Any size)

Lowest premiums (often <2%). Best for pure weight accumulation. Ensure they are in assay cards.

Jewelry

Chains, Rings

Worst investment. You pay 100-300% markup for design/labor, but can only sell it for melt value.